Sky (SKY) Valuation Snapshot (Nov. 2025)

Sky Protocol (SKY) remains the most durable and revenue-generating decentralized stablecoin issuer in crypto, and data suggests it may be significantly undervalued on both a relative and fundamental basis.

Executive Summary: Nov. 27, 2025

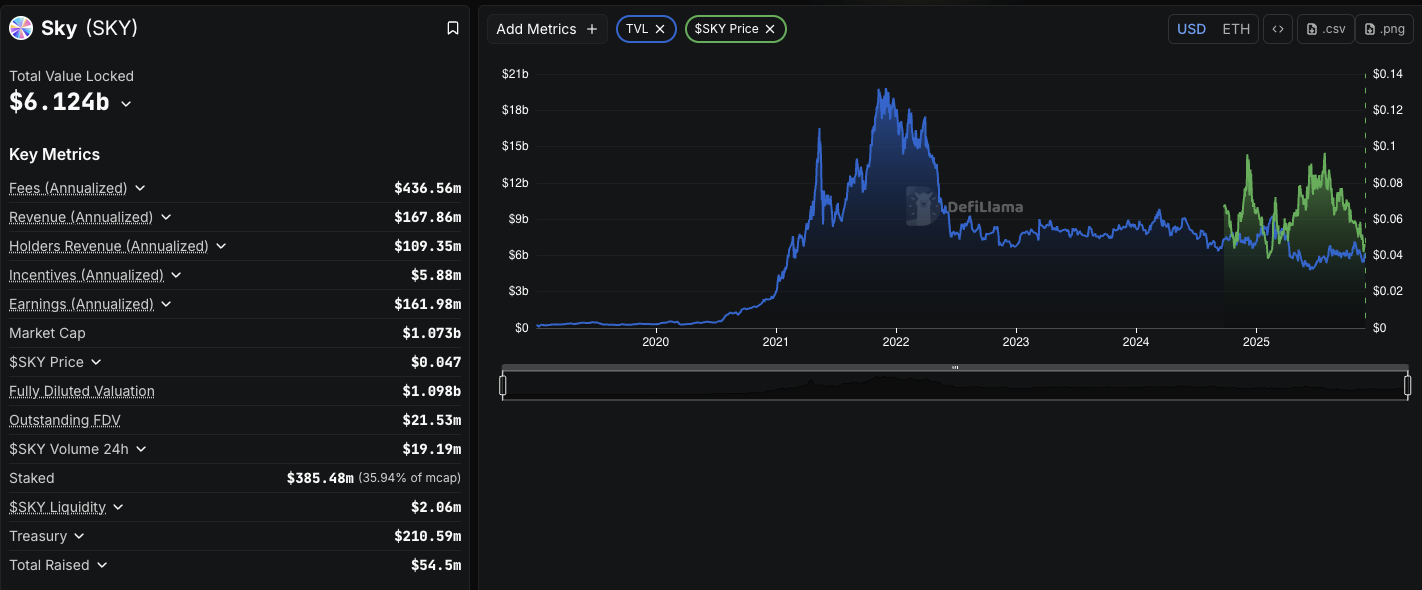

Sky protocol TVL and SKY token price, Nov. 27, 2025. Source: Defillama.

Sky Protocol (SKY) remains the most durable and highest revenue-generating decentralized stablecoin issuer in crypto. Core statistics include:

Market Cap: $1.06B

Annualized Fees: $414.36M

Annualized Protocol Revenue: $142.76M

P/F Ratio: 2.51

P/S Ratio: 6.53

TVL: $6.533B

While SKY’s price has declined ~35% over the past year, its fundamentals remain strong. Its valuation is low both in absolute terms and relative to peers in the decentralized stablecoin and RWA-backed protocol sector.

Notably, 47% of the protocol’s lifetime fees and 35% of lifetime revenue were generated in the last 12 months, evidence of accelerating fee generation and durable cash flow.

A meaningful portion of retained revenue ultimately benefits SKY holders via staking rewards and buybacks. Over the last year, Sky has distributed $104.12M to tokenholders through staking rewards and repurchased over 1.3B SKY (totaling $87M USDS) at an average price of $0.0628 since the launch of its buyback program in February 2025.

In this valuation snapshot, we’ll review:

How Sky Generates Revenues

USDS/DAI Collateral Types

SKY’s Relative Valuation

SKY Fundamental Valuation Ranges

Potential Risks

Findings and Conclusion

1. How Sky Generates Revenues

Sky’s revenue is unusually diversified for a stablecoin protocol, and includes:

Stability Fees on USDS Minting

Users who borrow USDS against collateral (ETH, wstETH, SKY) pay a continuously accruing Stability Fee. This remains one of the protocol’s most stable revenue sources.

USDS Savings Rate Spread

Sky earns RWA yield (e.g., U.S. Treasuries) at higher rates than it pays to USDS savers (currently 4.5%). The yield spread, after accounting for the protocol’s risk buffer, accrues to the protocol as revenue.

Vault Liquidation Penalties

When collateralized positions fall below threshold levels, they are liquidated, generating penalty fees captured by the protocol.

Together, these make Sky resemble a decentralized fixed-income protocol, rather than a trading or leverage-driven DeFi system.

2. USDS/DAI Collateral Types

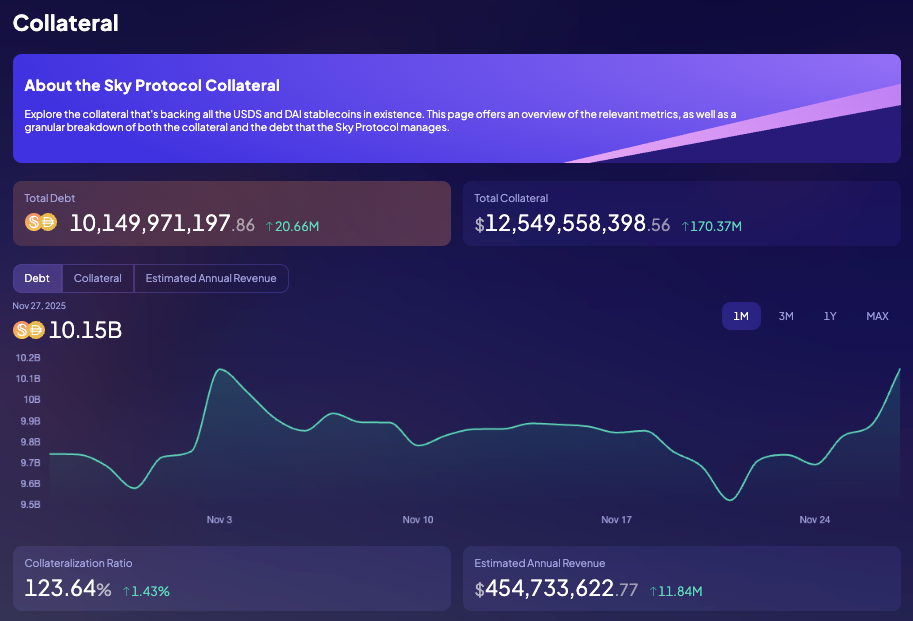

Sky Protocol Collateral dashboard, Nov. 27, 2025. Source: Sky.

USDS is currently slightly more than 123% overcollateralized, and has approximately $12.5B in collateral backing all USDS and DAI in circulation. Sky structures collateral into functional categories, including:

$3.74B: Stablecoins (LitePSM): Primarily USDC for peg stability and liquidity routing.

$3.66B: Spark: The Sky-affiliated lending market where users borrow USDS; generates Stability Fees.

$1.88B: Grove (RWAs): Tokenized institutional credit and short-duration fixed income (including AAA-rated notes).

$2.31B: Core: Decentralized crypto collateral (ETH, WSTETH, WBTC).

$150M: Obex: Cross-chain liquidity management for USDS and sUSDS.

$101.5M: Legacy RWA: Maker-era RWA positions predating Endgame.

$663.85M: StakingEngine: SKY deposited for governance, rewards, and collateralized borrowing.

Note: These categories reflect Sky’s internal collateral and liquidity architecture. Some represent subsystems that manage or deploy collateral, so the amounts should not necessarily be summed linearly.

3. SKY’s Relative Valuation

A. Price-to-Fees (P/F)

Sky’s P/F = 2.51, low for a protocol generating over $400M in annualized fees, most of which stem from relatively low-risk RWA yield.

Peer comparison (DefiLlama, Nov. 2025):

Sky trades at a steep discount to both major decentralized dollar issuers.

B. Price-to-Revenue (P/S)

Sky’s P/S = 6.53, based on $142.8M in annualized revenue.

Peer comparison:

Frax (FXS): P/S = 41.50

Ethena (ENA): P/S = 3,484.47*

Sky has one of the highest revenue-capture efficiencies in the sector.

*This high P/S ratio is due to the fact that Ethena distributes revenues to stablecoin holders, not holders of ENA.

C. Market Cap to TVL (MCAP/TVL)

TVL: $6.52B

Market cap: $1.06B

MCAP/TVL = 0.162

Comparables:

ENA: 0.27

FRAX: 0.146

Sky trades at a conservative valuation despite strong revenue dynamics.

D. Capital Efficiency: Sky vs. Ethena vs. Frax

Sky (SKY)

Fees: $414M

Revenue: $143M

Capture: ~34%

Value Capture: Strong (buybacks + staking)

Ethena (ENA)

Fees: ~$360M+

Revenue: $597.5k

Capture: Minimal

Value Capture: Near zero

As mentioned previously, Ethena passes nearly all economic value to sUSDE holders, not ENA holders.

Frax (FXS)

Fees: $11.75M

Revenue: $1.83M

Capture: ~15%

Value Capture: Mixed (varies with AMO policy and veFXS voting)

4. SKY Fundamental Valuation Ranges

Below, we will calculate the fundamental value of SKY under bear, base, and bull market conditions, using the formula:

Value = (Forward Revenue × Market Multiple)

Bear Case

Revenue: $100M

P/S: 4×

FV: $400M

Downside: ~60%

Historical note: Maker/SKY last traded near a $500M market cap during the 2022 cyclical bottom.

A high level of staking participation (approx. 62% of circulating supply earning 16.8% SKY APR + 18.7% Spark APR) reduces free-float supply, which can help dampen short-term sell pressure. However, it does not eliminate the fundamental downside.

Base Case

Revenue: $140–150M

P/S: 6–8×

FV: $900M–$1.2B

Downside: ~0%

This is the most probable scenario given stable RWA yields and modest USDS growth.

Bull Case

Revenue: $200–225M

P/S: 17× (Sky’s July 2025 peak multiple)*

FV: $3.4–3.8B

Upside: ~200–250%

This scenario requires a continuation of the crypto bull cycle and persistent RWA yields above cash rates.

*Sky’s P/S ratio reached 17.14 on July 27th, 2025, when the token hit a localized high of $2.01B, with an annualized revenue of $117.40M.

4. Potential Risks

Potential risks to the long-term value of SKY may include:

RWA Yield Compression: A sustained drop in Treasury yields or RWA credit yields would compress protocol revenue.

Stablecoin Demand/Peg Risk: Significant outflows from USDS or loss of peg could destabilize collateral/backing ratios.

Regulatory Risks: Potential stablecoin/asset-backed token regulation, especially for RWA-backed stablecoins, could lead to access or legal issues in the U.S., EU, or other major markets.

Token Dilution/Tokeconomics Changes: Future changes to fee-distribution policy or inflation could reduce value capture.

Macro/Rate Risk: While a drop in rates would compress revenues, a prolonged high-rate environment may reduce demand for stablecoins and borrowing, lowering fee generation.

5. Findings and Conclusion

Sky appears undervalued relative to both peers and its own historical multiples. Strong revenue capture, rising protocol surplus, active token buybacks, and a robust staking system create a compelling case for long-term tokenholder value.

Because Sky’s revenue base is anchored by RWA yield, its cash flows are more stable and less cyclical than competitors like ENA (derivatives-based yield) or FXS (more reliant on incentives and AMOs).

If market conditions revert to valuations seen earlier in 2025, SKY could see substantial upside, while high staking participation and a large RWA-backed surplus may help moderate short-term downside pressures.

Sources:

The State of Decentralized Stablecoins in 2025

Decentralized stablecoins have struggled to scale without compromising on either decentralization or stability. In this analysis, we review the history of decentralized stablecoins, including the UST collapse and the state of today’s protocols like MakerDAO (now Sky) and Frax.

Stablecoin market dominance chart, May 15, 2022. Source: Defillama.

Decentralized stablecoins once represented the future of censorship-resistant finance. By mid-May 2022, they captured nearly 17% of the global stablecoin market, with $31.6B in total market cap. Most of that $31.6 was composed of just five assets, including:

TerraUSD (UST): $18.67B (10.02% of total stablecoin market cap)

DAI: $6.6B (4.39%)

FRAX: $2.09B (1.41%)

Magic Internet Money (MIM): $1.07B (0.57%)

Neutrino USD (USDN): $935M (0.5%)

In the golden era before the TerraUSD (UST) collapse, decentralized stablecoins were considered a credible threat to USDC and USDT. But this golden era was short-lived. Within weeks of UST’s peak, the algorithmic stablecoin catastrophically lost its peg and collapsed from a $18.67 billion market cap to under $220 million, triggering one of the most significant capital destructions in crypto history. This shook investor confidence in decentralized stablecoins and ushered in a long slide in their share of the market.

Though decentralized stablecoins once represented nearly one-sixth of all stablecoins in circulation, by May 2025, that number had collapsed to less than 5%.

Moreover, while the post-Terra collapse left an opening for “better-designed” decentralized alternatives to rise, the opposite happened. Liquidity, integrations, and trust flowed back toward centralized incumbents—especially USDC and USDT, now accounting for nearly 90% of all stablecoin volume and usage.

In this analysis, we’ll review the past and present state of decentralized stablecoins, including the 2022 disaster that shook the market, and the current condition of the two largest decentralized stablecoin protocols that have survived multiple market cycles: MakerDAO (now Sky) and Frax. We’ll also lightly touch on a few other protocols and ask whether decentralized stablecoins will ever recover the popularity, trust, and market share they once had.

TerraUSD (UST): The Black Swan

Total value locked (TVL) in Terra (now Terra Classic), May 6, 2025, directly before UST de-peg event. Source: Defillama.

First, look at the algorithmic stablecoin that ruined it for everyone else. No stablecoin collapse was more dramatic than that of TerraUSD (UST):

Peaked at $18.67B market cap and 10% market share

Depegged in May 2022 and fell to $0.2144 within weeks

Market cap eventually collapsed to under $220M — a 99% drop

Though now rebranded as TerraClassicUSD (USTC), the market never recovered. The Terra (LUNA) token (now known as Terra Classic, or LUNC) peaked at $105.82 with a $37.4B market cap, and now trades for less than a cent.

The Terra collapse triggered well-deserved regulatory crackdowns, investor skepticism, and existential questions about the inherent stability of algorithmic stablecoins during times of market distress-- and created a shift in perception that changed the industry’s perception of fully algorithmic stablecoins from magic crypto money machines to cruel Ponzi schemes.

How UST Collapsed

Backed algorithmically by its sister token LUNA, UST was designed to maintain its peg through an arbitrage mechanism: users could swap $1 of LUNA for 1 UST and vice versa, regardless of market price. However, this system relied heavily on continued market confidence and utility, which proved unsustainable.

Total value locked (TVL) and cumulative USD inflows on Anchor, the most popular DeFi protocol on the Terra blockchain, before the UST depeg in early May 2022. Source: Defillama.

A liquidity pool attack on Curve’s 3pool in May 2022 initiated a cascade: UST lost its peg, triggering redemptions that required minting massive amounts of LUNA. This hyperinflation crashed both tokens’ value in a textbook death spiral, wiping out over $40 billion in investor wealth within days. Anchor Protocol, which offered unsustainably high 20% yields to UST depositors, exacerbated the fragility by concentrating over 75% of UST’s demand in a single speculative use case.

While the Luna Foundation Guard (LFG) attempted to deploy over $1.5 billion in BTC reserves to defend the peg, the effort failed. Arbitrage incentives collapsed, confidence evaporated, and by mid-May 2022, both UST and LUNA were trading near zero.

MakerDAO (now Sky): No Longer an Industry Darling

Total value locked (TVL) in the broader MakerDAO ecosystem peaked in early November 2021, at more than $19.2B. Source: Defillama.

MakerDAO was once the world’s largest decentralized stablecoin, and its governance token, MKR, was a top #25 crypto asset by market cap. Today, however, things aren’t nearly as frothy.

DAI peaked in September 2021 with a 5.08% market share and $6.6B in supply, stabilizing at around $6.8B by September 2022 but with a reduced 4.23% share.

By September 2023, DAI’s market cap had fallen to $5.3B, with a 4.35% share. One year later, it dropped to 2.93% market share (~$5.4B).

The introduction of Sky Dollar (USDS)—DAI’s opt-in successor under MakerDAO’s rebrand—has since brought Sky’s combined market share back up to ~3.51% as of May 2025, with $5.36B in DAI and $7.99B in USDS.

However, both DAI and USDS rely heavily on RWAs and centralized collateral like USDC, which may be partially why S&P Global rated USDS’ stability level as a 4, or “constrained,” the second-lowest possible stability rating. S&P cited governance centralization, undercollateralization risk in long-tail vaults, and dependence on custodians for RWA liquidation as significant risk factors.

S&P also ranked Tether (UDST) as “constrained”, citing a lack of information on custodians and bank account providers, in stark contrast to the 2, or “strong” rating S&P gave Circle’s USDC stablecoin.

Sky’s Shift Towards Centralization (and Loss of Utility)

Outside concerns from TradFi institutions, DeFi natives have also critiqued USDS due to Sky’s introduction of a freeze function, prompting debates about its censorship resistance.

Additionally, the financial and community incentives and unique positioning of MakerDAO as a “decentralized bank” that went as far as to help finance real-world businesses, like a Tesla dealership, has become another DeFi protocol with limited value-added incentives for users.

A 2025 report from Delphi Digital highlighted a key differentiator that once set DAI apart: it had escaped the “subsidy trap.” According to analyst Facundo Indabera: “$DAI had successfully escaped the decentralized stablecoin flywheel, where it didn’t need to subsidize demand (as $USDS is doing) because users wanted to hold it and use it...”

The Stablecoin Flywheel (utility, cost-of-capital, protocol financial health, and risk). Source: Delphi Digital.

The “flywheel” Indabera describes operates as follows:

→ Users hold stablecoin for its utility, not yield

→ Lowers the cost of capital

→ Improves protocol financial health

→ Reduces the risk of holding the stablecoin

→ Encourages more users to hold

But with DAI shifting to USDS, subsidized yield through Spark, and reliance on RWAs and USDC, this flywheel may be spinning in reverse.

DAI and USDS: Collateral and Collateralization Ratio

Decentralized stablecoins have made progress regarding collateral transparency, but things are far from perfect.

According to the Sky Ecosystem dashboard, as of May 11, 2025, there was approximately $8.19B of combined DAI and USDS in circulation and $10.59B in collateral, leading to a collateralization ratio of 129.3%.

As of May 2025, USDS and DAI’s collateral was comprised roughly of:

Stablecoins: 34%, mainly in USDC reserves, via the Peg Stability Module, or PSM

Crypto Assets: 25.9%, crypto, including variations of wrapped and staked ETH and wrapped BTC

DeFi Yield Vaults: 36.4% is deployed through SparkLend D3M modules, which deploy DAI/USDS into various yield-earning integrations with DeFi platforms, spread across isolated vaults, each with its own liquidation rules.

1% in legacy RWAs

2.6% in Seal Engine, a component of Sky that allows anyone to lock MKR tokens as collateral to borrow USDS

However, it appears that Sky has shifted approximately 25% of the collateral it had in a money market RWA vault (the Blocktower Andromeda vault) in December 2024 into the other collateral types mentioned above.

In short, even with a reduced reliance on RWAs in recent months, even if the Sky’s contracts are decentralized, the collateral is not.

While the DAI/USDS system includes a surplus fund (currently ~$49M) to cover shortfalls, Sky will resort to backstopping via minting of SKY tokens if that doesn't maintain the dollar peg. This dynamic introduces additional risk during market stress, and reminds some of the fully algorithmic stablecoin model that sank UST. As the aforementioned S&P report notes, reliance on minting governance tokens to patch collateral gaps is a potential red flag-- not a reasonable fail-safe.

Governance: MakerDAO’s MKR (Now SKY)

MakerDAO’s governance token, MKR, now rebranded as SKY, was initially conceived as the decentralized mechanism through which the community managed DAI’s risk parameters. But in practice, MKR governance has long been criticized for its low voter turnout, opaque decision-making, and founder dominance.

The recent rebranding to Sky as part of Founder Rune Christensen’s “Endgame” strategy only reinforced these concerns:

Nearly 80% of the vote share to keep the Sky brand came from just four entities.

Founder Rune Christensen still exercises substantial influence over roadmap decisions.

SubDAOs and the SKY token introduce new governance complexity but do not necessarily increase decentralization.

MKR launched at just $24.45 in 2017, peaking at $5,280 in May 2021, meaning that early investors would have seen a gain of more than 21,400% had they bought at launch and sold at MKR’s all-time high.

Unfortunately for recent investors, MKR’s price action over the last few years has reflected today’s more cautious narratives around decentralized stablecoins. Despite its incredible runup from 2017 to mid-2021, by January 2023, MKR had collapsed to $513. A spurt of market enthusiasm did see MRK recover to $3,924 in March 2024, but the token has again fallen rather sharply, with the token sitting at $1,854 as of mid-May 2025, suggesting wavering faith in Sky’s governance model and long-term product-market fit.

Frax: An Ecosystem Trying To Find Its Place

Frax ecosystem total value locked (TVL) before UST depeg in early May 2022. Source: Defillama.

While Sky’s DAI and USDS stablecoins have lost noticeable market share. Frax’s original dollar stablecoin, Frax (FRAX), now called Legacy FRAX, followed a steeper decline:

FRAX peaked at a 1.58% stablecoin market share on March 6, 2022, and reached an all-time-high market cap of $2.09B a few days later.

By May 2022, FRAX’s market cap had fallen almost 40% to $1.41B, and had dropped below $670M by late 2023.

As of May 10, 2025, Legacy FRAX holds just $315M and 0.136% of the market. Frax’s new stablecoin, frxUSD, launched in February 2025, has only $77.8M in market cap. Combined, the ecosystem now holds just 0.169% of the stablecoin market.

Frax’s Hybrid Approach: From FRAX to frxUSD

Frax began as a partially algorithmic stablecoin, using a dynamic collateral ratio based on market demand. This design, hailed as a breakthrough in capital efficiency, ultimately proved too fragile. Following its collapse in adoption, Frax now takes a fully collateralized route with:

Legacy FRAX, primarily crypto-collateralized, is gradually being phased out by frxUSD

frxUSD is backed mainly by RWAs, including BlackRock’s tokenized BUIDL fund

Frax Price Index (FPI) remains a second, CPI-pegged stablecoin with adaptive yield mechanics.

While frxUSD aims to ensure solvency by tapping institutional-grade assets, it raises philosophical concerns. Its dependency on BlackRock, one of the world’s largest financial institutions, introduces a centralized point of failure, undermining the stablecoin’s decentralization premise.

If regulators or custodians halt access to the BUIDL fund, frxUSD could face liquidity and redemption issues, despite being “technically decentralized.”

The Frax ecosystem’s assets are significantly less collateralized. As of May 11, 2025, Frax’s core stablecoin had assets of $357.5M and liabilities of $370.6M, giving it a collateralization ratio of just 96.5%. In contrast, FPI had assets of $100.2M and liabilities of $96.7M, giving it a collateralization ratio of 103.6%.

Governance: Frax’s FXS and FPIS

Frax takes a more modular approach. Its ecosystem relies on FXS (Frax Shares) as the primary value accrual token and previously launched FPIS (Frax Price Index Share) as the governance and seigniorage token for the CPI-pegged FPI stablecoin.

FXS acts as the governance token for the Frax ecosystem—its value reflects overall usage and fee generation across all Frax products.

FPIS, in contrast, captures only the excess yield generated by FPI, above CPI inflation.

Frax believes this model added unnecessary complexity, which is why Frax will be phasing out FPIS will be phased out by March 2028. FPIS can be converted to FXS at a 2.5:1 ratio, consolidating Frax governance around a single token.

Despite major protocol upgrades, like MKR, Frax’s governance token has also suffered declining sentiment around decentralized stablecoin protocols:

FXS peaked at $38.15 in May 2022

Reached a high of $842M market cap in Feb 2023

Trades at just $2.65 with a $239M market cap as of May 2025

Frax Price Index (FPI): Inflation-Pegged Stability

While much of Frax’s recent story has been a tale of a slow decline, they have had a small degree of success with one product, Frax Price Index (FPI). FPI is the first stablecoin pegged not to the U.S. dollar but to a basket of real-world consumer goods, tracking the U.S. CPI-U index via a specialized Chainlink oracle. Designed to preserve purchasing power over time, FPI:

Maintains a soft peg to CPI-adjusted value since Dec. 2021

Grew ~13% in value as of May 2025 — outpacing the official ~7.7% cumulative CPI inflation (despite real inflation likely being higher)

Is backed by 100% collateral, primarily FRAX, and governed by AMO contracts

Uses its own governance token, FPIS, now being phased out in favor of FXS

FPI has seen limited adoption despite strong on-chain mechanics, with a market cap of just $96.51M — roughly 0.041% of the total stablecoin market. While theoretically successful, it remains niche and underutilized outside DeFi-native circles.

MIM: A Curious Survivor

Total value locked (TVL) of Abracadabra before the reveal of 0xSifu as ex-con and QuadrangleCX founder Michael Patryn in January 2022. Source: Defillama.

At its peak in early 2022, Magic Internet Money (MIM) represented nearly 0.5% of the global stablecoin market with a market cap of $4.67 billion. Issued by the Abracadabra.money protocol, MIM stood out by allowing users to borrow against interest-bearing and yield-generating tokens like yvUSDC, xSUSHI, and yvWETH—collateral types that many other protocols avoided due to complexity.

However, after revelations that one of Abracadabra’s semi-anonymous co-founders, Michael Patryn (a.k.a. 0xSifu), was a convicted felon involved in the fraudulent collapse of Canadian crypto exchange-cum-ponzi scheme QuadrigaCX, public trust evaporated. Within six months, the protocol’s TVL plummeted from over $6.3 billion to just a few hundred million. Today, it sits below $41 million, while the MIM stablecoin’s market cap sits around $104 million.

Yet despite the reputational collapse, MIM quietly continues to operate and has remarkably maintained its peg to the dollar. It does this through overcollateralized lending—users deposit volatile or yield-bearing assets and mint MIM against them, with liquidation mechanisms ensuring peg support.

When MIM trades below $1, arbitrageurs buy and repay debt for profit; when above $1, new MIM is minted and sold, pushing the price down. While this design has proven resilient in narrow technical terms, it came at the cost of scale and credibility. Once an ambitious player in the decentralized stablecoin space, MIM now survives more as a curiosity—stable, yes, but largely forgotten.

Do We Even Need Decentralized Stablecoins?

All of this brings us to a broader question: do we need decentralized stablecoins? While crypto may have been born due to the desire to decentralize our financial system, it doesn’t mean that every aspect of the industry benefits from decentralization.

Decentralized proponents argue yes to our question, pointing to:

Censorship resistance (no freezing or blacklists)

Programmatic monetary policy (e.g., DAI's Target Rate Feedback Mechanism)

Global accessibility (DeFi composability without KYC)

However, detractors counter that stable collateral is often centralized (USDC, RWAs) and that most users care more about stability, liquidity, and fiat off-ramps than ideology.

As the aforementioned report from Delphi Digital observed, DAI once escaped the "decentralized stablecoin flywheel" by becoming genuinely helpful, but projects like its successor, USDS, have reverted to subsidizing usage, a financially unsustainable approach.

Institutional Adoption and Use-Cases

Decentralized stablecoins were once envisioned as censorship-resistant alternatives to fiat, but by 2025, compliance-first, RWA-backed models have gained dominance. The most significant growth comes from traditional financial players rather than crypto-native DAOs.

In just the past month:

Visa partnered with Bridge to deploy stablecoin infrastructure

Fidelity revealed plans to launch its own stablecoin

Stripe unveiled stablecoin-based business accounts

Meta is reportedly revisiting stablecoin ambitions post-Diem

These moves signal that the technology behind stablecoins is winning, but not necessarily in its decentralized form. Instead, large institutions are building regulated, closed-loop systems with fiat off-ramps and custodial control.

Even some DeFi-native protocols are gravitating toward real-world assets (RWAs), centralized oracles, and governance dominated by a handful of whales. For example, MakerDAO’s “Endgame” plan now features the aforementioned freeze function, a significant USDC dependency, and off-chain Treasury bill exposure via custodians like Wedbush Securities.

What Comes Next?

Sky vs. Ethena monthly protocol fees, May 2024 to May 2025. Source: Token Terminal.

Decentralized stablecoins have struggled to scale without compromising on either decentralization or stability. While early leaders like DAI and FRAX innovated new models and earnestly tried to reinvent the global financial system, both now rely heavily on off-chain collateral and governance structures that few would call trustless.

In contrast to early projects, which may have had more ambition than product-market fit, newer decentralized stablecoin protocols are more niche, like Ethena’s USDe and M0. USDe, which mainly functions as a DeFi investment product, is a synthetic, yield-bearing stablecoin backed by delta-neutral strategies using ETH staking rewards and perpetual futures, rather than traditional fiat or crypto collateral. In contrast, M0, an a16z-backed protocol that provides a composable infrastructure layer where developers can launch their branded stablecoins using the $M base asset and modular “extensions,” seems to be designed for smaller-cap stablecoins with unique features.

These trends hint at a future shaped not by ideology but by profit, utility, and institutional adoption. Whether truly decentralized money ever returns to the center of crypto remains uncertain, but the dream of reliable, censorship-resistant digital dollars hasn’t fully died-- at least not yet.

Blockchain Oracles in 2025: Market Dynamics, Risks, and the $108B Race for Data

Oracles are the unseen engine behind DeFi. By enabling smart contracts to ingest real-world data, like asset prices, exchange rates, or economic indicators, they allow decentralized protocols to function in ways once reserved for centralized financial institutions.

The top 5 blockchain oracle tokens by market cap, May 2024 to May 2025: Source: Token Terminal.

Oracles are the unseen engine behind DeFi. By enabling smart contracts to ingest real-world data, like asset prices, exchange rates, or economic indicators, they allow decentralized protocols to function in ways once reserved for centralized financial institutions.

From lending platforms to derivatives markets and insurance protocols, oracles are essential. As of May 10th, 2025, according to Defillama, blockchain oracles secured more than $108.13 billion in assets. Yet despite this foundational role, oracles remain under-discussed, under-valued, and, at times, dangerously under-secured.

Over the past five years, the oracle landscape has matured. Chainlink still dominates, but its share is shrinking as nimble, chain-specific, and faster-moving protocols like Pyth, RedStone, and Chronicle carve out distinct niches and solidify their market share. This comes when new demands are being placed on oracles—from real-time AI agents and RWAs price feeds to automated DeFi execution.

At the same time, oracles continue to be a weak point in DeFi’s attack surface. While attacks as large as 2022’s $112 million Mango Markets exploit haven’t been seen in several years, the industry still has its fair share of issues. From the $7.5 million price manipulation attack on KiloEX to recent oracle-related controversies on platforms like Polymarket, oracles have been a recurring target for hackers, bad actors, and opportunists.

This report explores the evolution of oracles, their attack history, market share shifts, and how new shifts, like the explosive growth of AI agent-based blockchains and tokenized RWAs, are changing how oracles are deployed and how they’ll need to evolve to secure the future of decentralized finance.

The Oracle Problem: Reliability, Security, and Decentralization

DeFi protocols are only as decentralized (and as secure) as the data they use. This principle underscores the ongoing “oracle problem,” a foundational challenge in decentralized finance: how to securely, reliably, and efficiently bring off-chain data into on-chain environments.

The oracle problem closely mirrors the blockchain trilemma. Oracles must balance three competing priorities:

Security (resisting manipulation or tampering),

Decentralization (avoiding single points of failure), and

Latency (delivering data fast enough for dynamic, real-time use cases).

In most cases, improving one of these variables undermines another. A more decentralized system may lead to slower data throughput, and a faster oracle might lean on centralized infrastructure. At the same time, a highly secure feed could be too expensive or impractical for composable smart contracts.

Most price oracles today aggregate data from off-chain APIs or exchange feeds, which exposes them to multiple risks:

Exchange manipulation (e.g., thin liquidity on obscure pairs)

Flash loan attacks that inflate or collapse asset values

Censorship risk (if the feed is run by a single party or cloud provider)

These risks are not theoretical. Time and again, DeFi applications have been exploited due to faulty or manipulable data sources, and oracles remain the most important bulwark against (and often, the most vulnerable attack surface for) a variety of attacks on decentralized networks.

A Brief History of the Oracle Market

Chainlink Total Value Secured (TVS) chart, $61.21 billion as of May 11, 2025. Source: Defillama.

The external oracle market has evolved significantly since 2019, maturing from a niche function into a critical pillar of decentralized finance. Initially, Chronicle, the in-house oracle for MakerDAO, was the only major player in the oracle space. However, with the launch of Chainlink in May 2019, the competitive landscape shifted dramatically.

By September 2019, Chainlink had already captured over 30% of the market.

By July 2020, during DeFi Summer, it peaked at 67% market share.

By May 2021, Chainlink held 74.2%, with Chronicle at 16.1%, Band at 4.4%, and WINKLink at 2.3%.

That same year, internal oracles—custom solutions embedded directly into dApps—rose in popularity, especially across the Terra ecosystem. By April 2022, internal oracles secured over 16% of TVS across DeFi. But their rapid collapse following Terra’s implosion reduced their share to nearly zero in less than 48 hours, underscoring the risks of opaque or project-specific oracle systems.

Blockchain oracles Total Value Secured (TVS) chart (2019 to May 2025), percentages as of May 26, 2022. Source: Defillama.

By May 2022, the landscape looked like this:

Chainlink: 61%

Chronicle: 19.2%

WINKLink: 5.4%

Pyth: 4.6%

Band: 1.7%

Others like RedStone, Switchboard, TWAP, and SEDA represented the remaining fraction of market share.

From mid-2023 to mid-2025, the oracle market began to stabilize. While remaining a clear market leader, Chainlink has slowly ceded share to newer, more agile protocols, and Pyth, RedStone, WINKLink, and Chronnicle have each maintained around 10% of the market’s total value secured.

Blockchain oracles Total Value Secured (TVS) chart (2019 to May 2025), percentages as of May 12, 2025. Source: Defillama.

Below is the breakdown of the top oracle protocols by TVS as of May 9, 2025:

Chainlink: 54%

Pyth: 11% (up from just 2% in 2023)

RedStone: 9.7%

WINKLink: 10.5%

Chronicle: 11.9%

Switchboard: 3.6%

Supra: 0.9%

Other players like Edge, API3, and Band maintain marginal market share. API3, once a VC favorite, has declined from over 2.3% in March 2024 to under 0.9% today.

Chain-Specific Penetration

Solana blockchain oracles Total Value Secured (TVS) chart (2019 to May 2025), percentages as of May 12, 2025. Source: Defillama.

While global TVS rankings offer a high-level view, market share varies widely by blockchain. For example:

Pyth dominates Solana, securing over 47% of the chain’s TVS (~$3.96B).

Switchboard holds another 32% on Solana (~$2.7B), but only 3.6% globally.

Conversely, Chainlink retains strong dominance on Ethereum and Avalanche, while newer entrants are gaining ground on Layer 2s like zkSync and Base.

The takeaway: while Chainlink remains dominant, its lead is narrowing. New entrants like Pyth, RedStone, and WINLink are carving out specialized roles through faster settlement, chain-specific focus, or integrated automation features.

Oracle Attacks: Exploits, Losses, and Vulnerabilities

Oracle manipulation attacks, total value stolen and number of attacks by year, 2020-2022. Source: Chainalysis.

Oracle manipulation has been one of DeFi’s most persistent and expensive vulnerabilities. In 2022 alone, Chainalysis estimated that $403.2 million was lost across 41 separate oracle-based exploits. And while attack frequency has declined, this likely reflects the rise of easier attack surfaces—like bridges and protocol logic bugs—rather than genuine improvements in oracle security.

Unfortunately, DeFi’s reliance on oracles means that even one compromised feed can trigger systemic losses.

Case Study: The Mango Markets Exploit (2022)

Mango Markets TVL during oracle price manipulation attack, Oct. 2022. Source: Defillama.

The most infamous oracle attack to date occurred on Mango Markets, a Solana-based DeFi trading protocol, which lost $112.2 million in a single exploit.

Here's how it worked:

Price Manipulation on Centralized Exchange:

The attacker acquired MNGO tokens and used them to manipulate the price of MNGO on FTX, temporarily inflating it by 300% within 10 minutes.

Inflated Collateral Value:

Mango relied on external oracle feeds that referenced centralized exchange prices. By inflating MNGO’s price, the attacker drastically increased their collateral value on Mango.

Massive Loans:

Using the now-overvalued MNGO collateral, the attacker took out massive loans in stablecoins and other assets, draining the platform.

Exit and Negotiation:

The attacker offered to return part of the funds in exchange for a “bounty” and immunity from prosecution. Mango's DAO voted to accept the deal, highlighting governance centralization and reputational risk.

This was not a failure of internal logic—it was a failure of oracle design. Mango pulled prices from a venue that could be manipulated cheaply and quickly. It showed how oracles can be both economic and technical attack surfaces.

Other Examples of Oracle Exploitation

X user Folke Hermanssen (@hermansen_folke) accuses Polymarket of fraud on March 11, 2025: Source: X.

Several other, somewhat more recent oracle exploits and issues include:

KiloEx (2025): A $7.5 million loss occurred after a permissionless function was exploited to manipulate pricing. The DEX halted operations, promised full user compensation, and offered a 10% APY bonus to stakers affected.

Vow Protocol (2024): Vow’s team made the mistake of testing rate changes live on its mainnet. During a brief 15–30 second window, an attacker minted v$2 billion using just 20 million VOW, netting $1.2 million in profits. Notably, this was not an external oracle attack, and instead a failure of Vow’s internal oracle, but it illustrates the importance of using secure, auditable, and external data feeds for valuation.

zkSync ERC-4626 Vault Attack (2025): An attacker used a flash loan to manipulate the exchange rate of Mountain Protocol’s wUSDM token, inflating it from 1.06 to 1.7, then used the inflated value to take out a loan from Venus Protocol, causing a $717K loss.

Polymarket + UMA (2025): In a high-profile reputational case, users accused UMA whales of manipulating prediction market outcomes on Polymarket by staking large amounts of UMA behind inaccurate resolutions. This included a market that resolved “yes” on a U.S.-Ukraine mineral deal that never happened. While not a technical hack, this event exposed governance manipulation risks in oracle-based systems.

Why Attacks Have Slowed—But Not Stopped

While headline oracle attacks are less frequent in 2024–2025, this should not be mistaken for progress. The shift is likely due to:

Easier attack vectors (e.g., bridges, protocol logic)

Hardened infrastructure around top-tier oracles

Smarter attackers targeting less-audited systems

Yet oracles remain an ever-present systemic risk. As DeFi scales into RWAs, AI agents, and automated trading, the stakes are only getting higher.

Oracle Market Shifts, AI, and Real-World Assets (RWAs)

The oracle landscape in 2025 is undergoing structural changes, driven by the rise of decentralized AI ecosystems and the rapid growth of tokenized real-world assets (RWAs). These developments are reshaping how oracles are designed, who builds them, and how they're integrated into blockchain systems.

AI-Native Oracle Models

As decentralized AI protocols mature, a new class of oracle systems has emerged—ones built natively into AI networks, not bolted on from the outside.

Bittensor, an L1 blockchain for machine learning coordination, uses its validator layer as a built-in oracle. The protocol connects blockchain consensus to off-chain AI model evaluation. In practice, validators determine the value of AI outputs submitted by miners, creating an incentive system akin to traditional oracle consensus—what Bittensor calls Proof of Intelligence. This oracle-like functionality enables real-time coordination, rewards, and data validation without relying on third-party feeds. Each subnet within Bittensor can have its task-specific oracle logic, reinforcing the protocol’s modular architecture and decentralization.

The Artificial Superintelligence Alliance (ASI)—formed by the merger of Fetch.ai, Ocean Protocol, and SingularityNET—has also taken a native-oracle approach. Rather than rely on external solutions like Chainlink or Pyth, ASI protocols use Fetch.ai’s Autonomous Economic Agents as oracles. These “Digital Twins” can aggregate data from APIs, sensors, and even other agents, acting as programmable data providers for smart contracts. This system is:

Decentralized by design, with cryptoeconomic incentives and reputation layers;

Integrated with CosmWasm, leveraging Cosmos SDK's flexibility;

Tailored for AI use cases, such as on-chain inference, agent coordination, and predictive modeling.

The key motivation for ASI’s native oracle architecture is tight integration between agents and execution, allowing real-world data to directly inform contract logic without waiting on external feeds. This creates more fluid, responsive AI systems and avoids bottlenecks that plague traditional oracle layers.

Virtuals Protocol, a modular infrastructure provider for AI agent networks, takes a hybrid approach. It’s designed to interface with multiple oracle solutions, depending on the data type needed. Chainlink and Band Protocol are commonly used, but depending on the market, the protocol may pull from Pyth, API3, or niche sources. This dynamic composition reflects a broader trend: AI systems need diverse data sources, and no single oracle can serve every purpose.

Oracles and the Rise of RWAs

Total RWAs onchain, May 12, 2025. Source: RWA.xyz.

Parallel to the rise of AI, tokenized real-world assets (RWAs) are accelerating demand for high-fidelity oracles. According to RWA.xyz, as of May 12, 2025, over $22.06 billion in RWAs are hosted on-chain, excluding stablecoins. These include:

$12.9B in tokenized private credit

$6.9B in U.S. Treasuries

$1.5B in commodities

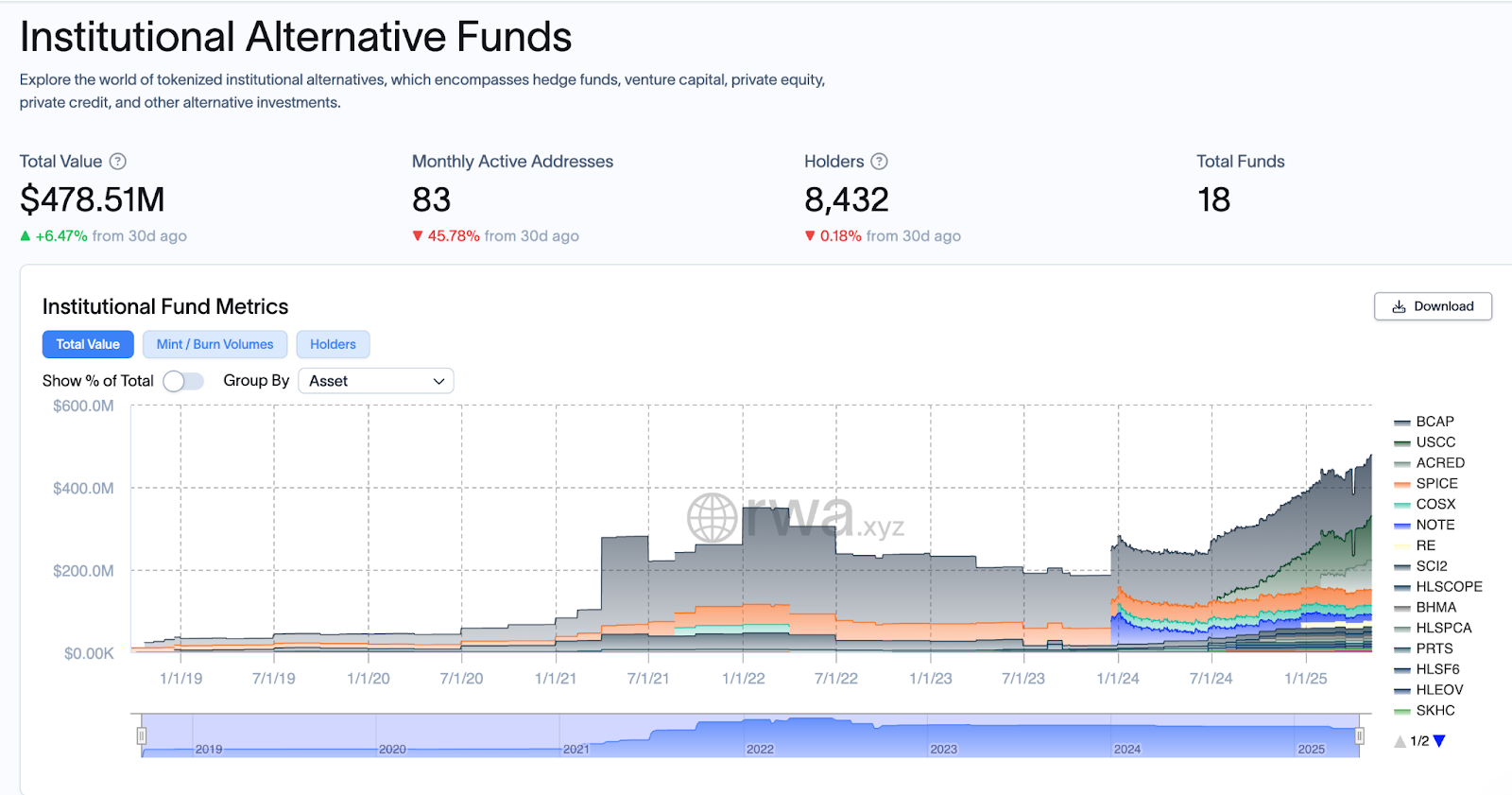

$478M in institutional alternative funds

Total Institutional Alternative Funds onchain, not including private credit or commodities, May 12, 2025. Source: RWA.xyz.

The RWA category is increasingly led by institutional-grade products, such as:

The BlackRock USD Institutional Digital Liquidity Fund (BUIDL), with a market cap of $2.87B, utilizes the Securitize tokenization protocol (which itself uses RedStone as its core oracle provider)

Tether Gold (XAUT) and Paxos Gold (PAXG), with market caps of $831M and $799M, respectively (XAUT uses DIA as its oracle, while PAXG leverages Chainlink for oracle price feeds)

Franklin Templeton and Ondo Finance on-chain Treasury funds (Ondo primarily uses Pyth, though Chainlink is also used in some functions)

In addition, several institutional-grade private funds have moved on-chain, most notably:

Blockchain Capital III Digital Liquid Venture Fund (BCAP): A tokenized crypto/blockchain VC fund with a $148M market cap, issued by Securitize (RedStone)

Superstate Crypto Carry Fund (USCC): On-chain crypto fund with a focus on yield-generation, with a $107M market cap, issued by Superstate (which uses Chainlink for USCC, but internal oracles for some other funds)

Apollo Diversified Credit Fund (ACRED): A multi-asset credit fund issued via Securitize (RedStone), combining a mix of public and private credit investments, with a $71M market cap

As these assets grow, so does the need for trustworthy oracles to provide interest rates, NAV updates, and off-chain valuation data in a transparent and verifiable way.

Why this matters: Traditional oracles focused on crypto-native prices (ETH, BTC, etc.). RWA oracles must bridge the gap between off-chain TradFi systems and on-chain DeFi protocols, often pulling from regulated sources, delayed settlement data, or proprietary pricing models. For tokenized bonds and credit instruments, this introduces challenges around:

Latency and frequency of updates

Verifiability and regulatory compliance

Auditability and legal accountability

Institutions entering DeFi will not accept opaque data pipelines. As such, RWAs are forcing oracles to professionalize, standardize, and support new feeds—a likely vector for innovation and consolidation in the next oracle cycle.

As DeFi Matures, and RWAs and AI Protocols Grow, Oracles Remain Essential

The oracle market has quietly become one of the most critical yet often overlooked components of Web3. Securing over $108 billion in value, oracles underpin everything from liquidations and leverage to RWAs and decentralized AI. As demands on smart contracts grow, the need for secure, real-time data has never been greater.

Chainlink remains the dominant player, but its lead has narrowed. Chain-specific and latency-optimized oracles like Pyth, RedStone, Switchboard, and WINLink are gaining traction as the market matures and diversifies. At the same time, the attack surface remains active.

From the $112M Mango Markets exploit to the KiloEx and zkSync vault attacks, oracle-based vulnerabilities continue to carry systemic risk. Meanwhile, controversies like Polymarket’s UMA resolution issues highlight how reputational trust in oracle networks can shape adoption.

The rise of decentralized AI and on-chain RWAs is accelerating change. Protocols like Bittensor and FET.ai’s Artificial Superintelligence Alliance are developing native oracle layers that fit their ecosystems, often favoring speed, customization, and control over third-party feeds. In 2025 and beyond, the winners won’t just secure user assets but deliver the fastest, most verifiable information to power decentralized systems.