Sky (SKY) Valuation Snapshot (Nov. 2025)

Executive Summary: Nov. 27, 2025

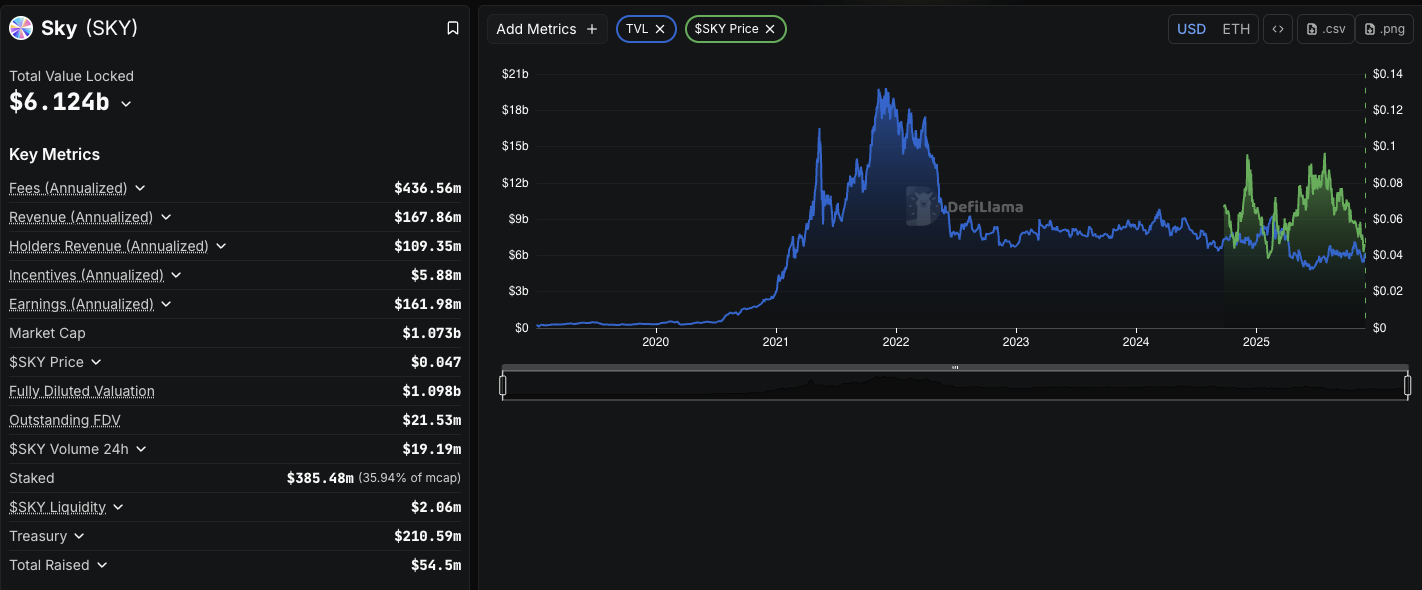

Sky protocol TVL and SKY token price, Nov. 27, 2025. Source: Defillama.

Sky Protocol (SKY) remains the most durable and highest revenue-generating decentralized stablecoin issuer in crypto. Core statistics include:

Market Cap: $1.06B

Annualized Fees: $414.36M

Annualized Protocol Revenue: $142.76M

P/F Ratio: 2.51

P/S Ratio: 6.53

TVL: $6.533B

While SKY’s price has declined ~35% over the past year, its fundamentals remain strong. Its valuation is low both in absolute terms and relative to peers in the decentralized stablecoin and RWA-backed protocol sector.

Notably, 47% of the protocol’s lifetime fees and 35% of lifetime revenue were generated in the last 12 months, evidence of accelerating fee generation and durable cash flow.

A meaningful portion of retained revenue ultimately benefits SKY holders via staking rewards and buybacks. Over the last year, Sky has distributed $104.12M to tokenholders through staking rewards and repurchased over 1.3B SKY (totaling $87M USDS) at an average price of $0.0628 since the launch of its buyback program in February 2025.

In this valuation snapshot, we’ll review:

How Sky Generates Revenues

USDS/DAI Collateral Types

SKY’s Relative Valuation

SKY Fundamental Valuation Ranges

Potential Risks

Findings and Conclusion

1. How Sky Generates Revenues

Sky’s revenue is unusually diversified for a stablecoin protocol, and includes:

Stability Fees on USDS Minting

Users who borrow USDS against collateral (ETH, wstETH, SKY) pay a continuously accruing Stability Fee. This remains one of the protocol’s most stable revenue sources.

USDS Savings Rate Spread

Sky earns RWA yield (e.g., U.S. Treasuries) at higher rates than it pays to USDS savers (currently 4.5%). The yield spread, after accounting for the protocol’s risk buffer, accrues to the protocol as revenue.

Vault Liquidation Penalties

When collateralized positions fall below threshold levels, they are liquidated, generating penalty fees captured by the protocol.

Together, these make Sky resemble a decentralized fixed-income protocol, rather than a trading or leverage-driven DeFi system.

2. USDS/DAI Collateral Types

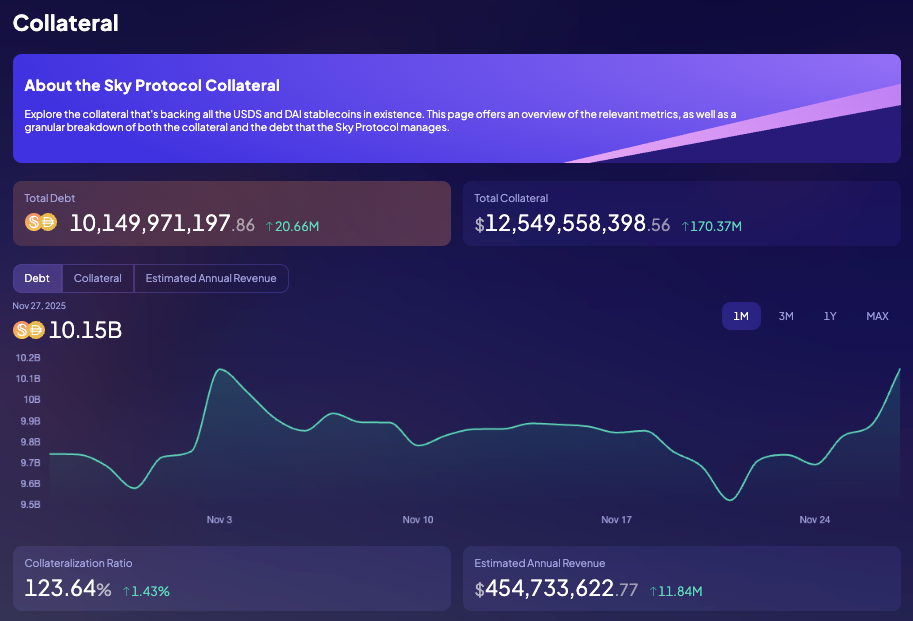

Sky Protocol Collateral dashboard, Nov. 27, 2025. Source: Sky.

USDS is currently slightly more than 123% overcollateralized, and has approximately $12.5B in collateral backing all USDS and DAI in circulation. Sky structures collateral into functional categories, including:

$3.74B: Stablecoins (LitePSM): Primarily USDC for peg stability and liquidity routing.

$3.66B: Spark: The Sky-affiliated lending market where users borrow USDS; generates Stability Fees.

$1.88B: Grove (RWAs): Tokenized institutional credit and short-duration fixed income (including AAA-rated notes).

$2.31B: Core: Decentralized crypto collateral (ETH, WSTETH, WBTC).

$150M: Obex: Cross-chain liquidity management for USDS and sUSDS.

$101.5M: Legacy RWA: Maker-era RWA positions predating Endgame.

$663.85M: StakingEngine: SKY deposited for governance, rewards, and collateralized borrowing.

Note: These categories reflect Sky’s internal collateral and liquidity architecture. Some represent subsystems that manage or deploy collateral, so the amounts should not necessarily be summed linearly.

3. SKY’s Relative Valuation

A. Price-to-Fees (P/F)

Sky’s P/F = 2.51, low for a protocol generating over $400M in annualized fees, most of which stem from relatively low-risk RWA yield.

Peer comparison (DefiLlama, Nov. 2025):

Sky trades at a steep discount to both major decentralized dollar issuers.

B. Price-to-Revenue (P/S)

Sky’s P/S = 6.53, based on $142.8M in annualized revenue.

Peer comparison:

Frax (FXS): P/S = 41.50

Ethena (ENA): P/S = 3,484.47*

Sky has one of the highest revenue-capture efficiencies in the sector.

*This high P/S ratio is due to the fact that Ethena distributes revenues to stablecoin holders, not holders of ENA.

C. Market Cap to TVL (MCAP/TVL)

TVL: $6.52B

Market cap: $1.06B

MCAP/TVL = 0.162

Comparables:

ENA: 0.27

FRAX: 0.146

Sky trades at a conservative valuation despite strong revenue dynamics.

D. Capital Efficiency: Sky vs. Ethena vs. Frax

Sky (SKY)

Fees: $414M

Revenue: $143M

Capture: ~34%

Value Capture: Strong (buybacks + staking)

Ethena (ENA)

Fees: ~$360M+

Revenue: $597.5k

Capture: Minimal

Value Capture: Near zero

As mentioned previously, Ethena passes nearly all economic value to sUSDE holders, not ENA holders.

Frax (FXS)

Fees: $11.75M

Revenue: $1.83M

Capture: ~15%

Value Capture: Mixed (varies with AMO policy and veFXS voting)

4. SKY Fundamental Valuation Ranges

Below, we will calculate the fundamental value of SKY under bear, base, and bull market conditions, using the formula:

Value = (Forward Revenue × Market Multiple)

Bear Case

Revenue: $100M

P/S: 4×

FV: $400M

Downside: ~60%

Historical note: Maker/SKY last traded near a $500M market cap during the 2022 cyclical bottom.

A high level of staking participation (approx. 62% of circulating supply earning 16.8% SKY APR + 18.7% Spark APR) reduces free-float supply, which can help dampen short-term sell pressure. However, it does not eliminate the fundamental downside.

Base Case

Revenue: $140–150M

P/S: 6–8×

FV: $900M–$1.2B

Downside: ~0%

This is the most probable scenario given stable RWA yields and modest USDS growth.

Bull Case

Revenue: $200–225M

P/S: 17× (Sky’s July 2025 peak multiple)*

FV: $3.4–3.8B

Upside: ~200–250%

This scenario requires a continuation of the crypto bull cycle and persistent RWA yields above cash rates.

*Sky’s P/S ratio reached 17.14 on July 27th, 2025, when the token hit a localized high of $2.01B, with an annualized revenue of $117.40M.

4. Potential Risks

Potential risks to the long-term value of SKY may include:

RWA Yield Compression: A sustained drop in Treasury yields or RWA credit yields would compress protocol revenue.

Stablecoin Demand/Peg Risk: Significant outflows from USDS or loss of peg could destabilize collateral/backing ratios.

Regulatory Risks: Potential stablecoin/asset-backed token regulation, especially for RWA-backed stablecoins, could lead to access or legal issues in the U.S., EU, or other major markets.

Token Dilution/Tokeconomics Changes: Future changes to fee-distribution policy or inflation could reduce value capture.

Macro/Rate Risk: While a drop in rates would compress revenues, a prolonged high-rate environment may reduce demand for stablecoins and borrowing, lowering fee generation.

5. Findings and Conclusion

Sky appears undervalued relative to both peers and its own historical multiples. Strong revenue capture, rising protocol surplus, active token buybacks, and a robust staking system create a compelling case for long-term tokenholder value.

Because Sky’s revenue base is anchored by RWA yield, its cash flows are more stable and less cyclical than competitors like ENA (derivatives-based yield) or FXS (more reliant on incentives and AMOs).

If market conditions revert to valuations seen earlier in 2025, SKY could see substantial upside, while high staking participation and a large RWA-backed surplus may help moderate short-term downside pressures.